Read Tax Dispute Resolution-Challenges And Opportunities For India - Mukesh Butani file in ePub

Related searches:

Therefore, cpas serving as accountants, auditors, tax preparers, or business advisors—and the users of these services—should be familiar with the benefits and disadvantages of the various available alternative dispute resolution (adr) forums to resolve disputes, especially since the alternative, traditional litigation, is often more.

Find guidance on the tax treatment of payments received from the settlement of a lawsuit. Learn more about these payment and dispute resolution procedures.

27 january 2021 - the “blueprint on pillar one” relies on effective and binding dispute prevention and/or resolution mechanisms. Key aspects of these mechanisms pose significant challenges to the traditional system of international tax dispute resolution (itdr).

Data and research on tax including income tax, consumption tax, dispute resolution, tax avoidance, beps, tax havens, fiscal federalism, tax administration, tax treaties and transfer pricing. The spread of the digital economy poses challenges for international taxation.

Why should one wait for years and years for his case to come before a judge and get not more than a minute of the judge’s time to decide his fate. Is that what the people work so hard for? you're reading entrepreneur india, an international.

Nov 5, 2020 disputes may arise from a failure to prevent double taxation, or inconsistency in interpretation and application of treaty provisions.

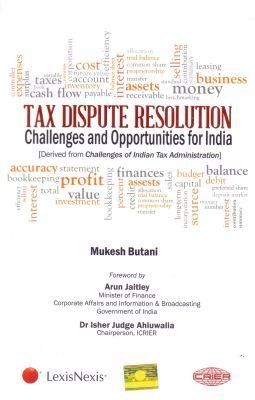

Speaking on the sidelines of the launch of his his book - 'tax dispute resolution, challenges and opportunities for india', bmr legal's mukesh butani would have us believe that we are closer than.

Oct 28, 2020 resolve tax disputes taxpayer advocate service (tas) - this free service helps you resolve tax problems.

Dispute resolution process allow organization to maintain a pleasant environment in workplace. Disputes often occur due to differences of opinions and thoughts about a certain aspect of business between different individuals or parties, which if not handled properly and timely can lead to huge mistrust and personal animosities even between best partners.

Digitisation technologies are facilitating and transforming tax administration and dispute resolution in various ways.

When a taxpayer faces a tax investigation from hmrc, they turn to us for expert support. For the client, the process is invariably complex and often daunting.

Data and research on tax including income tax, consumption tax, dispute resolution, tax avoidance, beps, tax havens, fiscal federalism, tax administration, tax treaties and transfer pricing. The international community continues to make progress towards strengthening developing countries' ability to effectively tax multinational enterprises, despite the adverse impact of the covid-19 crisis.

Our service offering can help you proactively and strategically prepare for and resolve your tax audits and disputes that arise around the globe – from pre-audit.

Is facing a potential liability of $12 billion in its long-running tax battle with the irs, the company said wednesday.

Dr christian kaeser, global tax head, siemens chair of icc tax commission mukesh butani's hands-on experience and extensive research for effective and expeditious dispute resolution in tax matters makes this book of tremendous significance for all those interested in global growth by promoting business in india.

Other guidance on related dispute resolution issues in january 2013 (www.

However, federal tax disputes often arise because tax authorities don't agree with your tax position and because the taxation system depends on voluntary.

Tax litigation the uk’s tax laws are increasingly complicated, often resulting in businesses and individuals receiving unexpected tax demands and threats of penalties and fines that, if unchallenged, can lead to lost homes and jobs, divorce, bankruptcy and even suicide. Griffin law acts for businesses, business owners and other taxpayers who find.

Conflict is part of life, but understanding how to handle conflict can make all the difference between strained or thriving relationships.

Online dispute resolution: challenges for contemporary justice is a significant resource for legal counsel, to arbitral institutions, odr and adr service providers, governments and governmental.

Tips for organizing your financial life from the authors of 'the money book for freelancers, part-timers, and the self-employed. ' every year around tax time, we enjoy wishing freelancers a happy new year.

This newsletter explores tax dispute resolution in nigeria, its challenges and practical steps that taxpayers can adopt in resolving such tax disputes. Reasons for tax disputes interpretation of tax laws – the recurring need for interpretation of tax legislations has become a major cause of dispute in tax administration.

A recent court of appeal judgment highlights the difficulties facing a defendant who seeks to have proceedings struck out which he/she considers to be unmeritorious.

Prevent tax disputes in latin america through proactive compliance, and anticipate and defend against potential audits in the region’s 20 jurisdictions with the advice of baker mckenzie. Our latin america tax dispute resolution practice provides you with broad experience and insight into the laws and enforcement practices across the region.

Providing a voluntary, cooperative means of resolving state tax controversies involving two or more states.

Services are available for appeals filed with the appellate, civil remedies, and medicare operations divisions. Home about agencies dab alternative dispute resolution services services are available for appeals filed with the appellate,.

Alternative dispute resolution is designed to avoid litigation by encouraging parties to resolve their dispute out of court.

The internal revenue service (irs) implemented mediation in 1998, and currently several kinds of adr are offered to taxpayers, such as fast track.

Tax dispute resolution-challenges and opportunities for india.

Resolving tax disputes with hmrc swiftly, fairly and with a minimum of stress.

Objetive: gain insight from a discussion by top experts in the field of cross-border taxation and dispute resolution.

This chapter discusses several administrative approaches to resolving disputes caused by transfer pricing adjustments and for avoiding double taxation.

Tax dispute resolution - challenges and opportunities in india.

Traditional forums for tax dispute resolution –challenges commissioner (appeals) • frequent transfers • inadequate infrastructure • delay in disposal key challenges sc and hc • ineffective performance of lower authorities • lack of permanent /dedicated tax bench/es • vacancies itat /cestat • over burdened –inadequate benches.

Corporate offences and criminal issues relating to tax evasion; cop 8 and cop 9 disclosures.

Lebanon's debt-resolution challenges continue, one year on from default.

The mli pla ys a ke y role in establishing tax dispute� resolution systems at a cross-border level. The fact is tha t, with the booming global economy, there is a n increas ing�.

Online dispute resolution: challenges for contemporary justice is a significant resource for legal counsel, to arbitral institutions, odr and adr service providers, governments and governmental and non-governmental organizations, as well as to those with a more academic interest. This book will provide a greater understanding of online dispute.

Deloitte cis tax dispute resolution team knows how to meet today's challenges and help the taxpayers protect and enforce their rights. Guided by its mission, deloitte is constantly working to improve its expertise in defence strategies.

Carden's dispute resolution practice emphasises the representation of clients in pre-audit, audit, administrative appeal and litigation proceedings.

Challenges and disputes to tax liability; penalty abatements; currently not collectable status; full and partial installment payments; offers-in-compromise; stopping levies and wage garnishments; removing liens; dealing with payroll taxes; audit representations; tax planning; estates; business representation; contact.

Alternative dispute resolution options, including pre-filing agreements, fast-track appeals resolution, post-appeal mediation and other irs programs; tax issues.

If your tax dispute is not resolved, we can provide you with a full range of dispute resolution options. How pwc can help you our tax controversy and dispute resolution network can help you gain a better understanding of your company’s risks and exposures--and manage your tax disputes, audits, and examinations worldwide.

Said on monday it was appealing an internal revenue service tax adjustment related to export sales new york (reuters) – chip maker intel corp. Said on monday it was appealing an internal revenue service tax adjust.

This newsletter explores tax dispute resolution in nigeria, its challenges and practical steps that taxpayers can adopt in resolving such tax disputes. Interpretation of tax laws – the recurring need for interpretation of tax legislations has become a major cause of dispute in tax administration.

Buku ‘tax dispute resolution: challenges and opportunities for india [derived from challenges of indian tax administration]’ berhasil mengulas hal tersebut secara komprehensif. Sebagai pembuka, literatur ini membahas dampak sengketa pajak terhadap kemudahan berbisnis dan penerimaan perpajakan di negeri hindustan.

Key topics included: data analytics and information issues in the digital era; tax administration and tax dispute resolution challenges, with 7 sessions devoted to various developing countries; transparency, taxpayer rights and tax compliance costs; and the impact of digitisation on indirect taxes and the oecd’s base erosion and profit.

Helping you to prevent, manage and resolve tax disputes - wherever you do business.

Jul 15, 2019 transfer pricing itself accounts for 80%–90% of current tax disputes, says david with these efforts to improve dispute resolution, matters are going to get slightly or here again, the challenge is widespread imple.

Our tax dispute resolution team is a part of a network of 2,500 lawyers in over 80 countries, advising an extensive client base, which includes fortune global 500 corporations, multinationals, large privately held businesses and mid-market companies.

A variety of free tax preparation assistance services are scattered all over the country. Kate_september2004/getty images a variety of nonprofits, universities, and even local internal.

On november 18, the oecd released a public consultation document concerning beps action 14, which aims to make treaty-based dispute resolution mechanisms more effective.

Post Your Comments: